Do you love your bank? Does it give you value for money and great customer service? Is it the cornerstone of your financial life or a necessary evil?

However you feel, the good news is that you can expect things to get better.

As in so many sectors, technological innovation is shaping the future of banking and offering incumbent institutions a choice – take advantage of the shiny new opportunities or be challenged by the insurgent start-ups that are doing just that.

Scale is no defence. A raft of new legislation has been drafted to create the environment for competitive innovation and to allow smaller players opportunities to break into newly evolving markets.

Consumers stand to benefit from this concerted drive to open up the banking sector to make it more competitive and to drive value and choice.

In the UK, the Competition and Markets Authority (CMA) is imposing – their word – an Open Banking revolution after an investigation finding “older and larger banks do not have to compete hard enough for customers’ business”.

Then there is a newly updated EU Payment Services Directive – PSD2 – that will end banks’ monopoly on their customers’ data. The idea is allow third party companies to shake up the market by offering services that sit between a bank and a customer.

Internet of Me spoke to eWise, a company that occupies this middle ground and offers solutions to both fintech innovators and financial institutions, about this new landscape of challenges and opportunities.

CEO David Hamilton started by telling how eWise was born out of a similarly disruptive climate in the Australian banking marketplace back in the late 90s and early 2000s.

eWise CEO David Hamilton

A period of disintermediation saw non-bank and non-regulated business models emerge and proliferate, undercutting traditional banks to offer mortgage and credit products and services. Customers went from having just one or two relationships with financial institutions to having a whole range covering the spectrum of products.

“The number of institutions people were doing business with exploded,” says David. “The underlying hypothesis we had was that although people were beginning to demonstrate this unbundling behaviour, at some point they would want to rebundle them back together, at least from a money management perspective in order to get a clearer picture of their finances.”

PSD2 is designed to turbo-charge this intermediate market between the big financial players and their customers by creating third party payment processors (TPPs) with two key functions: the Payment Initiation Service Provider (PISP), which initiates payments for the user, and the Account Information Service Provider (AISP), which offers an aggregated overview of accounts.

The latter is right in the sweet spot of what eWise – now headquartered in Switzerland – is doing for its clients.

David says: “While many banks are scratching their heads about how to comply with PSD2 regulation a lot of our customers are looking beyond to whether open banking APIs are the way forward and how they can take advantage of that and go well beyond the scope of what PSD2 is asking for and offer a more comprehensive set of banking data APIs that we can monetise.”

Monetising bank APIs

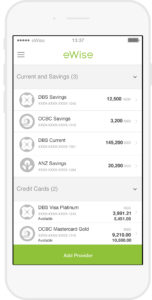

The eWise solution is to provide account aggregation that happens at the user end rather than on banks’ servers. Data is held securely on a personal data vault downloaded onto the user’s desktop or device. The eWise Personal Financial Management tool then gives them baseline account information that only they can see. Users can then permit sharing of data to enable features such as cashflow forecasting, budgeting and spending analysis.

The eWise mobile app

“They can then turn off that data sharing at any point and they can be quite granular about which accounts they choose to share data from,” says David. “For example, I might choose to share data on my credit card and current account so my spend analysis is accurate and my cashflow forecasting is accurate. But I might choose to keep my saving accounts and investment and data on my insurance products completely private, so that data never leaves my personal data vault. I can see everything in one place but the data is fully encrypted and stored locally.”

So the zeal for reform of the financial services sector by governments and regulators represents a boom time for start-ups and other innovative newcomers to the market. But, as David explains, that doesn’t mean there is anything to stop the incumbent players from getting a slice of the action.

“I think there’s a lot of noise around the fintech start-up scene and the potential for that scene to disrupt certain parts of the banking value chain. There’s actually very little discussion around banks themselves becoming payment initiation service providers. Banks have played a role in online merchant transaction acquisitions now for decades and we don’t see why they wouldn’t want to continue to play that role.

“They’ve got a fairly large revenue base to protect and grow and we see them playing in that third party processor space very clearly. A lot of the banks we’re working with also believe there is a role for them to play as an account information service provider – as a trusted actor in the value chain providing aggregation services not just across payments but across all types of financial instruments.”

It certainly makes sense for banks to do so. While bodies like the CMA and the UK government feel banks have been failing their customers on value and service, it is still those banks that bear the brunt of regulatory burden in a way that footloose agile start-ups do not.

The banks’ advantage

However, while some might think this tilts the playing field too far in favour of the incomers, David believes the true picture is not necessarily a free-for-all at the expense of the banks.

In fact, he says, the Regulatory Technical Standards (RTS) drawn up by the European Banking Authority place such an emphasis on data security that it might initially play out better for the banks.

“There’s some conflict between what’s possible technically and the innovation people want to see driven by technology. When you look at the actual underlying approach from the regulators, the recent consultation paper on the RTS for access to accounts and strong customer authentication takes the view that security in many ways trumps customer experience and there will be more friction in the payments value chain than there was prior to PSD2 assuming the current RTS is enforced and not watered down.

“Things like the Amazon ‘one-click’, that wouldn’t comply with the currently written RTS for strong authentication because it would require, with exception of very low value transactions, multi-factor authentication on all payments occurring on a separate device from the payment itself. The way the regulatory technical specifications are being written they certainly favour the banking side more than they do the fintech innovator side, in my view.”

David points out that the key advantage for fintech operators, then, is their ability to focus entirely on innovation, certainly financially.

The FinTechs’ advantage

“From a software vendor standpoint the order book on our customer side has been heavily biased towards regulatory and compliance items,” he says. “If you look at the IT budget in banks today a good deal of it is going to be on regulatory compliance and little will go towards innovation.

“Think of a fintech, especially those that are not regulated, and effectively 100 per cent of their IT spend can be on innovation. So there is something of an asymmetry there in what banks have to spend money on and what a fintech has to.

“Having said that, the clients we do business with and those in our pipeline are looking to get on the front foot, particularly with respect to PSD2, and turn something that is compliance driven into something that could potentially be business model and revenue driven.”

So what could this market of the future look like?

“One could imagine a world where there is a virtual shop front – a broker if you like – that intermediates between the end consumer and different institutions they might want to do business with and they provide that much stronger level of customer service than the institutions might have done in the past.

“Institutions will need to decide whether they want to be that broker or storefront or whether they want to potentially just simply become a product or service provider to that ecosystem. There is some discussion around banks essentially just becoming ‘balance sheet as a service’ which means that someone could launch a new digital financial service offering to plug into a banking partner to leverage their balance sheet and leverage their banking charter but effectively become just the store front.”

There is a lot up for grabs. In its Global FinTech Report, PwC reckons FinTech investment will exceed $150billion within three to five years køb viagra.

The same report found that 75 per cent of senior executives in leading financial institutions thought the biggest impact will be an increased focus on the customer.

As with the EU General Data Protection Regulation, PSD2 is legislation that presents real challenges for the businesses it affects while also offering opportunity for those that embrace it in spirit as well as letter.

That alone has got to be good news for consumers.

What is significant is that such legislation drives the shift towards giving consumers greater control over their own data. And it clears the way for the innovators who tend to want to do just that.